With the president of the client organization the primary contact person, a four-year series of engagements developed and implemented a new strategy for organizing and operating the clerical functions and improve white-collar productivity of a 23-location insurance company.

Overview of the Client

The client was a non-General Fund, quasi-governmental state agency that serves as the provider of last resort of workers’ compensation coverage for employers within the state. Although it is a state agency, the client competes freely with and is required to conform to all the regulation of conduct of other insurance companies. It insures approximately one-half of the eligible employers and between 20% and 40% of the eligible workers in the state.

The client is intended to serve a “regulatory” function solely by demonstrating superior performance in state’s workers’ compensation insurance marketplace.

The client can be thought of as an insurance company with both “home office” departments/functions and field offices that provide the vast majority of the direct contact between the client and both its insured policyholders and the injured workers of those policyholders.

Included within the scope of the Office Services project were all clerical activities in the field offices. These activities included: mail services; computer operations; personnel functions; policy coverage verification; word processing; filing; data entry and check processing; and bill paying. These activities are vital to the functioning of the field offices. With the exception of personnel, the performance of each of these activities by a support or clerical person is intended to allow the technical or professional staff to devote the majority of their work day to more highly-skilled job duties.

Project Overview

The project’s charter was to determine the “best way” for the clerical activities of the field offices to be performed including who should perform them, at which point they should be performed, how personnel should be organized, and the staffing required to perform these activities. Included in the scope were the operations of the 23 field offices and associated legal operations. After 15 months, this charter was expanded to include the claims adjusting activities also. The objective was to enhance the ability of client personnel to deliver timely benefits to injured workers and keep costs to employers as low as possible rather than simply improving clerical processes.

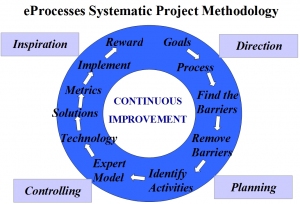

Activities were identified as to the flow of work, the reasons for the work, the frequency of the work and the time required to perform the work. Supervisory and hourly personnel provided written and oral suggestions for improving the processing of work. Focus Groups evaluated the suggestions and designed work flow recommendations to eliminate unnecessary and/or redundant work. The need to have staff dedicated to routing work between processing steps was reduced. Staff was effectively allowed more productive time. Work is organized around measurable units of work having defined start and stop points rather than around collections of tasks. This facilitates the management of the work process rather than of individual activities, reduces distances between work points and therefore backlog accumulation points, and increases control over and accountability for the status of the work.

A broad range of fact-finding and forecasting techniques were used including, but not limited to: Focus Groups within individual district offices; significant interaction with Home Office and staff functions and with all field office departments; comprehensive reviews of past studies and efforts; interviews with insurance industry experts outside the client organization; and data collection and survey techniques, including flow charting, statistical sampling, and application of work simplification, task analysis, methods and systems review. This methodology reflected a zero-based analysis of the basic claims products and processes.

This resulted in the development of “The Model Office” and the “Claims Adjustment Team.” These two processing models represent significant change in organizational structure. Claims Adjusting and Support functions are integrated into natural work units. Supervisory span of control was altered. Reporting relationships were modified. Wherever possible, proximity was improved. Premium-based staffing was replaced by staffing based on measurable work. The result was improved productivity, teamwork, sense of belonging and purpose, and customer service. Organizing into teams has improved the visibility of the numerous processes. This visibility facilitates continuous improvement. It is expected that this new organization will provide not only current improved benefit delivery but also better, more clearly defined employee career paths and increased responsiveness to future challenges.

Process oriented, activity based measurement focuses management attention on those elements that are directly within their control. The new organization structure and the increased productive time improved the ability of the field offices to effectively meet the needs expressed in its Mission Statement.

Management’s focus was altered to deal with effective overall benefit delivery rather than an orientation toward individual function within the benefit delivery system. The added benefit to this reorganization is improved communication with policyholders/employers, with injured workers, and with co-participants in the benefit delivery system.

A next step was an on-going assessment of and reaction to actual and anticipated changes in the client’s environment as they affect claims products and processes. This next phase marked the beginning of an on-going, comprehensive look at the foreseeable future and at the ever-changing Claims environment. An immediate goal of this new phase was the state-wide implementation of the recommendations.

Implementation of The Model Office began after a six-month development phase and continued across the state. The Claims Adjustment Team concept began a test phase fifteen months later with a final evaluation presented to the client’s executive committee 18 months later.

Project Results

Initial results included:

1. Prior to implementation of The Model Office, the time from receipt of a medical bill for payment until the payment of the average medical bill in most offices was in a range of from 40 to 60 days. In those offices which implemented The Model Office, the average time to payment dropped to within a range of from 14 to 21 days. In those offices that implemented the Claims Adjustment Teams, the time to payment was 7 days or less. In one office, the typical medical bill was paid on the day it was received.

2. Prior to implementation of The Model Office, lost or misplaced claims files were commonplace. After The Model Office was implemented, lost or misplaced claims files became rare. In those offices that piloted or implemented Claims Adjustment, no lost files were reported after implementation.

3. In The Model Office and (even more) in the Claims Adjustment Team offices, the sense of teamwork cooperation improved among affected office staff.

4. The acceptance of The Model Office as a basis for determining clerical staffing increased district management and senior management sense of control over the proper level of clerical staffing. Because the project coincided with unprecedented growth in new claims filed, it was not possible to evaluate actual staffing impact. However, during the initial roll-out of the Model, ten of the 23 field offices were found to have excess staff when compared to the Model. This excess staffing totaled 21.3 Full-Time Equivalents representing annualized labor costs of $536,760.

Under the Claims Adjustment Team concept, narrowly-defined clerical job classifications are to be eliminated. Few positions will be dedicated solely to clerical activities. Teams of technical, semi-professional, and professional claims staff, rather than individuals, will be assigned to caseloads. One technical team member will do all word processing, data entry/processing, filing, and other previously-clerical tasks. Routine claims adjusting activities will be completed by trained claims adjusters. More difficult, less routine decisions will be left to the most experienced adjusters within each team who will have ultimate responsibility and accountability for the progress of the team’s caseload through the adjusting process.

The benefits to the Claims Adjustment Team concept were:

- an increase in overall caseload per staff person (with a related decrease in claims expense per adjusted case);

- improved control over case activities and more timely benefit delivery (with the potential for reducing claims losses per adjusted case); and

- better-defined career paths and an improved sense of responsibility for case outcome on the part of all claims-related staff.

Pre-pilot estimates suggested that a net increase in claims caseloads would reduce required staffing by 282 non-supervisory positions with a total annualized personnel cost of $6.5 to $7.5 million and 28 to 35 supervisory positions with a total annualized personnel cost of between $980,000 and $1.4 million. (It should be noted that these savings are based on the actual versus recommended caseloads and spans of control at the mid-point of the project. It had previously been generally accepted that caseloads throughout the state were too high rather than too low.)